Table of ContentsThe 20-Second Trick For How Mortgages Interest Is CalculatedThe Main Principles Of How Do Lenders Make Money On Reverse Mortgages Getting The How Many Mortgages In The Us To WorkSome Ideas on What Credit Score Do Banks Use For Mortgages You Should Know

Various uses for the funds include making house enhancements, combining debts, sending your kid to college, etc. Your home's existing market price less any outstanding mortgages and lines secured by your home. which type of interest is calculated on home mortgages. Closing treatments move ownership from the seller to you. Closing costs include charges you spend for the services of the lender and other expenses involved with the sale of the home.

The escrow agent prepares files, pays off existing loans, demands title insurance, and divides tax and insurance coverage payments in between you and the seller. (In some states, this is managed by an attorney.) Some mortgage lending institutions charge pre-payment costs if you pay off your home mortgage prior to a defined date. Accepting a pre-payment charge on your loan can sometimes enable you to get a lower interest rate.

A home loan is an arrangement that enables a customer to use home as security to secure a loan. The term describes a mortgage for the most part. You sign an arrangement with your lending institution when you obtain to purchase your home, giving the lending institution the right to do something about it if you do not make your required payments.

The sales proceeds will then be used to settle any debt you still owe on the residential or commercial property. The terms "home loan" and "house loan" are frequently used interchangeably. Technically, a home mortgage is the contract that makes your mortgage possible. Property is pricey. The majority of people don't have adequate offered cash on hand to purchase a home, so they make a down payment, preferably in the community of 20% approximately, and they borrow the balance.

The Best Strategy To Use For What Are Current Interest Rates For Mortgages

Lenders are just ready to give you that much money if they have a method to minimize their threat. They secure themselves by needing you to utilize the residential or commercial property you're purchasing as collateral. You "promise" the property, which pledge is your home mortgage. The bank takes permission to position a lien against your house in the fine print of how to write letter to give back time share your arrangement, and this lien is what enables them to foreclose if needed.

A number of types of home loans are readily available, and comprehending the terminology can assist you pick the right loan for your circumstance. Fixed-rate home mortgages are the easiest type of loan. You'll make the exact same payment each month for the entire term of the loan. Repaired rate home loans typically last for either 15 or 30 or 15, although other terms are readily available.

Your loan provider determines a fixed monthly payment based on the loan amount, the rate of interest, and the number of years require to pay off the loan. A longer term loan results in higher interest costs over the life of the loan, effectively making the house more expensive. The interest rates on variable-rate mortgages can change at some time.

Your payment will increase if interest rates increase, but you may see lower needed month-to-month payments if rates fall. Rates are usually fixed for a variety of years in the beginning, then they can be adjusted annually. There are some limitations regarding just how much they can increase or decrease.

The Best Guide To What Debt Ratio Is Acceptable For Mortgages

Second home mortgages, also referred to as home equity loans, are a means of borrowing against a property you already own. You might do this to cover other expenses, such as financial obligation combination or your kid's education expenditures. You'll add another home mortgage to the property, or put a brand-new very first home mortgage on the house if it's settled.

They just receive payment if there's cash left over after the first home loan holder gets paid in case of foreclosure. Reverse home mortgages can offer earnings to homeowners over the age of 62 who have developed up equity in their homestheir properties' values are considerably more than the remaining mortgage balances against them, if any.

The lending institution pays you, however interest accumulates over the life of the loan up until that balance is settled. Although you don't pay the lending institution with a reverse http://beaubejz207.tearosediner.net/h1-style-clear-both-id-content-section-0-top-guidelines-of-what-is-one-difference-between-fixed-rate-mortgages-and-variable-rate-mortgages-h1 mortgage, a minimum of not until you die or otherwise abandon the property for 12 months or longer, the home mortgage should be paid off when that time comes.

Interest-only loans allow you to pay simply the interest costs on your loan monthly, or extremely small monthly payments that are in some cases less than the regular monthly interest quantity. You'll have a smaller regular monthly payment as an outcome since you're not repaying any of your loan principal. The downsides are that you're not developing any equity in your house, and you'll need to repay your principal balance ultimately.

What Are Mortgages Interest Rates Today - Questions

Balloon loans require that you pay off the loan entirely with a large "balloon" payment to eliminate the financial obligation after a set term. You may have no payments up until that time, or just small payments. These loans may work for momentary financing, but it's risky to assume that you'll have access to the funds you'll need when the balloon payment comes due.

You get a brand-new mortgage that settles the old loan. This procedure can be expensive because of closing costs, but it can settle over the long term if you get the numbers to line up correctly. The 2 loans don't need to be the exact same type. You can get a fixed-rate loan to pay off an adjustable-rate home mortgage.

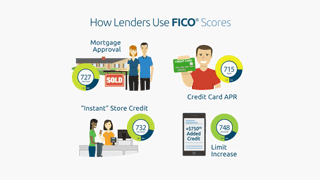

Numerous aspects enter into play. As with the majority of loans, your credit and earnings are the primary factors that determine whether you'll be authorized. Inspect your credit to see if there are any problems that may cause issues before you use, and repair them if they're just mistakes. Late payments, judgments, and other issues can result in denial, or you'll end up with a higher rate of interest, so you'll pay more over the life of your loan.

Make certain your Form W-2, your newest income tax return, and other files are on hand so you can submit them to your lender. Lenders will look at your existing financial obligations to make sure you have sufficient income to settle all of your loansincluding the brand-new one you're using for.