Home mortgage payments are structured so that interest is settled faster, with the bulk of home mortgage payments in the first half of your home mortgage term approaching interest. As the loan amortizes, more and more of the home mortgage payment approaches the principal and less towards its interest. Continue reading: Before you even use for a home loan, you have to get preapproved. Once you sign, these become what you have to pay. With a fixed-rate home loan, your rate of interest remains the very same throughout the life of the home loan. (Mortgages normally last for 15 or thirty years, and payments should be made month-to-month.) While this implies that your rates of interest can never go up, it also suggests that it might be greater on typical than an adjustable-rate home mortgage with time.

However, you generally get a specific variety of years at the beginning of the loan period during which the rates of interest is repaired. For instance, if you have a 7/1 ARM, you get 7 years at the fixed rate after which the rate can be changed as soon as annually. This implies your monthly mortgage payment might increase or down to account for changes to the rates of interest.

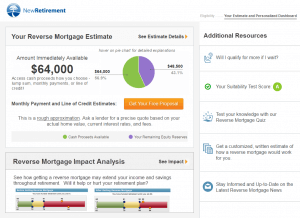

If you're 62 or older and want money to pay off your home mortgage, supplement your income, or spend for healthcare expenses you may consider a reverse home mortgage. It grace financial group llc permits you to transform part of the equity in your home into cash without having to offer your home or pay additional monthly bills.

A reverse home mortgage can use up the equity in your home, which suggests less assets for you and your successors. If you do choose to try to find one, review the different types of reverse mortgages, and contrast store prior to you pick a specific company - buy to let mortgages how do they work. Continue reading to read more about how reverse home mortgages work, getting approved for a reverse mortgage, getting the very best deal for you, and how to report any scams you may see.

The Main Principles Of How Do Mortgages Work Property Law

In a home loan, you get a loan in which the lending institution pays you. Reverse home loans participate of the equity in your house and convert it into payments to you a type of advance payment on your house equity. The money you get usually https://www.youtube.com/channel/UCRFGul7bP0n0fmyxWz0YMAA is tax-free. Usually, you don't have to pay back the cash for as long as you live in your home.

Sometimes that implies offering the home to get cash to repay the loan. There are 3 type of reverse home loans: single purpose reverse mortgages used by some state and local government firms, along with non-profits; proprietary reverse home loans private loans; and federally-insured reverse home loans, also called Home Equity Conversion Home Mortgages (HECMs).

You keep the title to your house. Rather of paying month-to-month mortgage payments, however, you get a bear down part of your house equity (how do arm mortgages work). The money you get generally is not taxable, and it generally will not affect your Social Security or Medicare benefits. When the last making it through debtor dies, offers the home, or no longer lives in the home as a primary house, the loan has actually to be repaid.

Here are some things to consider about reverse home loans:. Reverse home loan lending institutions usually charge an origination cost and other closing expenses, in addition to maintenance charges over the life of the home mortgage. Some likewise charge home loan insurance coverage premiums (for federally-insured HECMs). As you get money through your reverse mortgage, interest is included onto the balance you owe each month.

The Greatest Guide To How Do Land https://www.bloomberg.com/press-releases/2019-08-06/wesley-financial-group-provides-nearly-6-million-in-timeshare-debt-relief-in-july Mortgages Work

Many reverse home mortgages have variable rates, which are tied to a monetary index and change with the marketplace. Variable rate loans tend to offer you more alternatives on how you get your cash through the reverse home mortgage. Some reverse mortgages mostly HECMs provide fixed rates, but they tend to need you to take your loan as a lump amount at closing.

Interest on reverse home mortgages is not deductible on tax return till the loan is paid off, either partly or in complete. In a reverse home mortgage, you keep the title to your house. That indicates you are accountable for real estate tax, insurance coverage, utilities, fuel, upkeep, and other expenses. And, if you don't pay your real estate tax, keep house owner's insurance coverage, or keep your house, the lending institution may require you to repay your loan.

As an outcome, your lender may require a "set-aside" total up to pay your taxes and insurance throughout the loan. The "set-aside" minimizes the amount of funds you can get in payments. You are still responsible for maintaining your home. With HECM loans, if you signed the loan documentation and your partner didn't, in certain circumstances, your spouse might continue to reside in the house even after you die if she or he pays taxes and insurance coverage, and continues to keep the residential or commercial property.

Reverse home mortgages can consume the equity in your house, which means fewer properties for you and your beneficiaries. A lot of reverse home loans have something called a "non-recourse" provision. This indicates that you, or your estate, can't owe more than the worth of your home when the loan becomes due and the home is sold.

Some Ideas on How Do Mortgages Work When You Move You Need To Know

As you think about whether a reverse mortgage is right for you, also think about which of the three kinds of reverse home mortgage might best suit your needs. are the least costly alternative. They're offered by some state and regional government companies, in addition to non-profit organizations, however they're not readily available everywhere.

For example, the loan provider might say the loan might be utilized just to pay for house repairs, improvements, or residential or commercial property taxes. Many house owners with low or moderate earnings can certify for these loans. are personal loans that are backed by the business that establish them. If you own a higher-valued house, you may get a larger loan advance from a proprietary reverse home loan.

are federally-insured reverse mortgages and are backed by the U. S. Department of Housing and Urban Development (HUD). HECM loans can be used for any purpose. HECMs and exclusive reverse home loans might be more pricey than traditional home loans, and the in advance costs can be high. That is very important to consider, especially if you plan to remain in your house for just a brief time or obtain a little quantity.

In basic, the older you are, the more equity you have in your house, and the less you owe on it, the more money you can get. Before obtaining a HECM, you should meet with a therapist from an independent government-approved real estate therapy firm. Some lending institutions providing exclusive reverse home loans likewise require counseling.